Legally Pay Less Tax UK 2025 – ISA, Pension & HMRC-Approved Deductions – Save tax in 2025 legally: use ISAs, pension contributions, marriage allowance, savings & investment allowances. Maximise your deductions and reduce your UK tax bill.

Key Tax Allowances & Reliefs You Should Know for 2025/26

| Allowance / Relief | What It Means | Amount / Limit (2025/26) | Who It Helps Most |

|---|---|---|---|

| Personal Allowance | The amount of income you can earn before paying income tax | £12,570 | Everyone who’s employed or has taxable income under ~£125,140 |

| Income Tax Bands | How your income over the Personal Allowance is taxed | Basic rate (20%) up to £50,270; Higher (40%) up to £125,140; Additional (45%) above that. | Those with increasing income help with planning income, so less falls into higher bands |

| ISA Allowance | Tax-free wrapper for savings/investments; interest, dividends & growth are tax-free within ISAs | £20,000 per tax year for most people. | Anyone with savings/investments, especially useful for basic & higher rate taxpayers |

| Pension Contributions & Pension Tax Relief | Contributions toward a pension get tax relief, reducing taxable income | Annual allowance is £60,000 or 100% of earnings, whichever is lower. Tapered allowances for high earners may reduce this. | Those who are saving for retirement, high earners who need to plan carefully to avoid excess charges |

Strategies & Deductions to Legally Reduce Your Tax

Here are ways people commonly use to reduce or optimise their tax burden, all within HMRC rules.

1. Maximise Pension Contributions

-

Contribute up to your annual allowance (currently £60,000 or 100% of earnings) without incurring tax charges.

-

If you haven’t used your full allowance in previous tax years (the last 3 years), you can carry forward unused amounts.

-

Use relief at source or net pay arrangements, depending on your pension scheme. The method determines how tax relief is handled.

2. Use ISAs and Other Tax-Free Savings / Investments

-

Put up to £20,000 per year into ISAs (Cash ISA, Stocks & Shares, Innovative Finance, Lifetime ISA). Returns (interest, capital gains, dividends) are tax-free.

-

If you are nearing the ISA limit or have existing savings generating interest, consider shifting some into ISAs.

3. Take Full Advantage of Personal Allowances & Bands

-

Make sure you use the full Personal Allowance of £12,570. If your income is near £100,000, try to reduce adjusted net income to avoid losing allowance. GOV.UK+1

-

Be aware of the tapered annual allowance for pension contributions if your income (including employer pension contributions) is over certain thresholds. This can reduce how much you can contribute with full relief.

4. Marriage / Civil Partnership & Allowances

-

Marriage Allowance: If one spouse / partner has income below Personal Allowance and the other is a basic-rate taxpayer, you may transfer a portion of allowance to reduce the higher-income person’s tax.

-

Married Couple’s Allowance is available in limited circumstances (for one partner born before 6 April 1935), but this is less relevant for many people. PwC Tax Summaries

5. Check Savings & Dividend Allowances

-

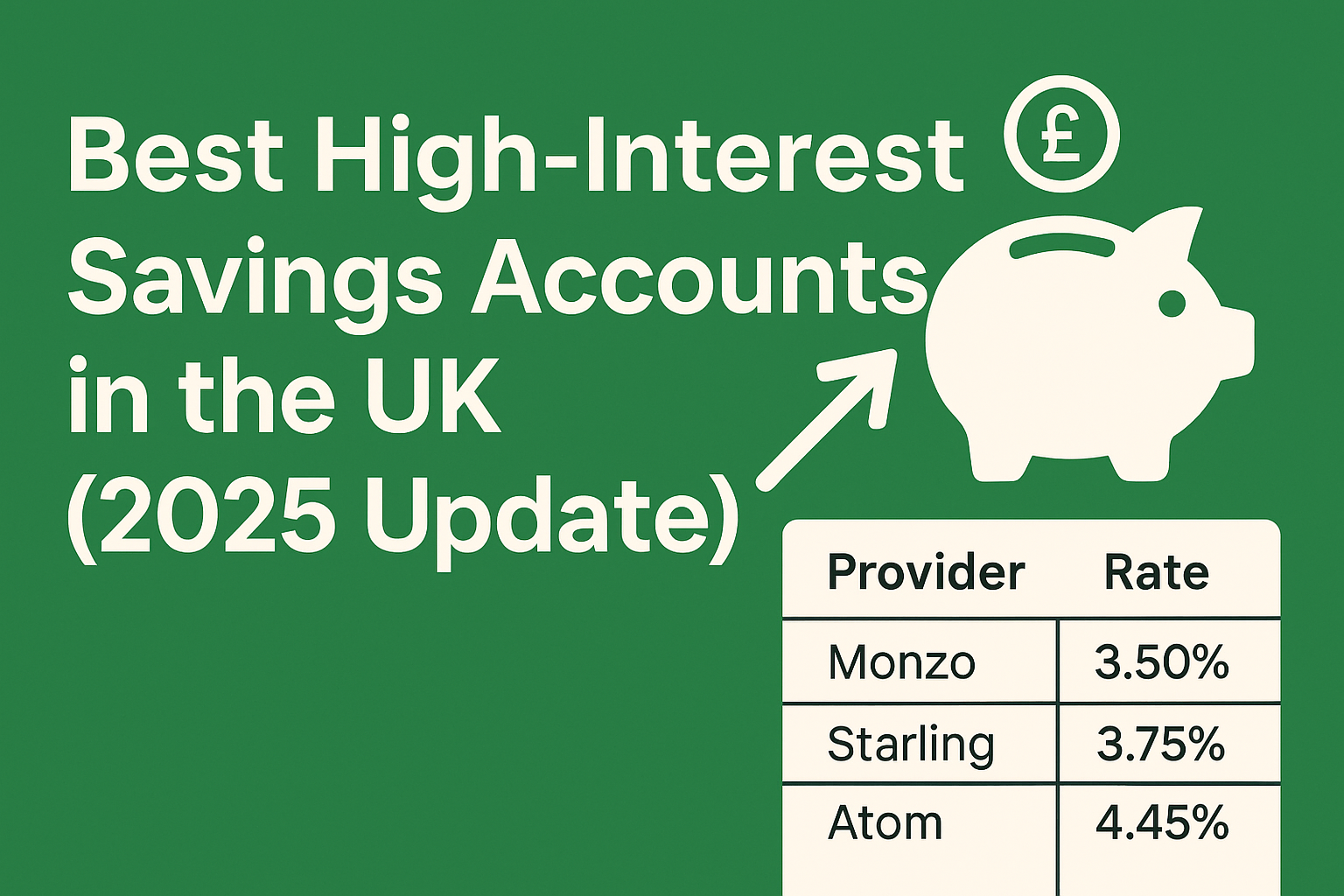

Personal Savings Allowance: Basic and higher rate taxpayers have a limit on how much interest can be earned tax-free. Be mindful so you don’t exceed it.

-

Dividend Allowance: Dividends you receive from shares or investments have a tax-free allowance. Consider structuring investments to use this.

6. Salary Sacrifice & Employer Benefits

-

Use salary sacrifice schemes (for example, pension contributions, childcare vouchers, bike-to-work schemes) to reduce your taxable salary and thus reduce income tax and National Insurance.

-

Review what benefits from your employer may be tax-efficient (e.g. employer pension contributions, health benefits, approved cycles)

What’s Changed / New in 2025 That Affects Tax-Saving

-

From 1 September 2025, HMRC tightened requirements for documentation when claiming pension tax relief for higher and additional rate taxpayers. Evidence will be required from your pension provider.

-

Savings interest tax traps are becoming more relevant: as interest rates rise, pensioners & savers may exceed their Personal Savings Allowance and pay more tax unless they use tax-free wrappers like ISAs.

Practical Steps You Can Take Before the End of the Tax Year

-

Review your pension contributions before the tax-year end (5 April) to see if you can make extra contributions or use carry forward.

-

Use your full ISA allowance. Any unused amount for 2025/26 will be lost.

-

Check that you are not missing any allowable deductions (e.g. work from home expenses, professional subscriptions if you are eligible).

-

Ensure your tax code is correct. Sometimes you overpay tax because of a wrong code.

-

If self-employed, keep accurate records of allowable business expenses. Claim what you’re legally allowed.

Common Mistakes to Avoid

-

Overestimating your earnings and getting caught by tapering or exceeding allowances.

-

Neglecting documentation for pension relief (especially now that HMRC is stricter).

-

Putting too much money in non-ISA savings and losing tax-free interest.

-

Missing deadlines (ISA contribution deadline, pension annual allowance, self-assessment filing).

Conclusion

Legally reducing your UK tax bill in 2025 often comes down to planning and using the allowances and reliefs available to you: ISAs, pension contributions, making sure your personal allowance is fully utilised, and staying on top of changes. If you’re unsure, it’s often worth seeking advice from a tax professional to ensure you’re optimising without risking compliance.